By Felipe Rezende

This is the first of a series of posts on the Brazilian crises.

There are two major crises Brazil’s president Dilma Rousseff is facing: one is a political crisis and the other is Brazil’s sharpest recession in 25 years.

Brazil’s Political Crisis

The political crisis has two main pillars: a) a vast corruption scandal (with evidence of a kickback scheme funneling billions of dollars from state-run firms and, more recently, in a massive data leak over possible tax evasion, Brazil politicians linked to offshore companies in Panama leaks); and b) impeachment proceedings to move forward against President Dilma Rousseff.

The Federal Court of Accounts (TCU) announced in 2015 that it had rejected the accounts of Rousseff’s administration for the year 2014. In a unanimous vote, the federal accounts court, known as the TCU, ruled Dilma Rousseff’s government manipulated its accounts in 2014 to “disguise fiscal deficits” as she campaigned for re-election. The allegation is that Ms. Rousseff manipulated Brazil’s account books to hide a growing fiscal deficit.

The argument is that the federal government borrowed money from public banks (which is forbidden by the fiscal responsibility law) to pay for social programs. So, they argued she allegedly committed an administrative crime.

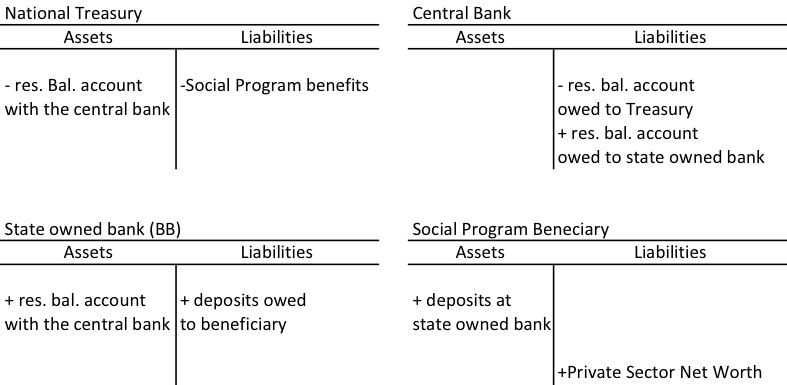

Once we understand how the government spend and what bonds are for, then we can analyze TCU’s decision. The Treasury has an account –known as Treasury Single Account- with the central bank. When the Treasury spends, its account with the central bank is debited and the bank’s account with the central bank is credited. This is followed by a credit to the beneficiary’s bank account. That is, the public bank then makes payments to the social program beneficiary by issuing deposits (case 1).

Case 1. The Treasury spends using its account with the central bank

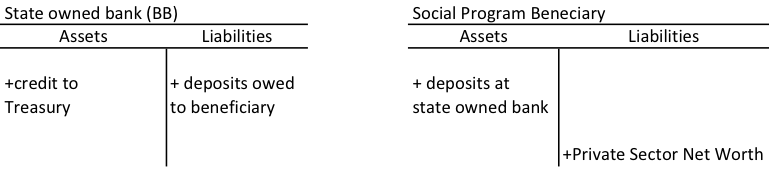

The issue at hand is that the federal government made payments for social programs using its public banks but it delayed payment to the same banks. That is, the federal government did not use its account at the central bank to credit the public banks’ account with the central bank while public banks made those social benefits payments. So, public banks made the payment (by creating demand deposits) and on the asset side there was in increase in credits (“loans”) to the Treasury (case 2), which is forbidden by the fiscal responsibility law. In a “normal” transaction banks reserve balances (that is government IOUs) with the central bank would go up, but because the Treasury delayed payments to banks there was in increase in balances owed by the Treasury to the public banks. This led the Federal Court of Accounts (TCU) to conclude that this was a “financing” operation.

Note that the fiscal responsibility law was initially drafted to avoid a situation in which state and local governments used their own regional banks to finance their expenditures (in Brazil there existed banks owned by local states). That is, it was as if the State of New York had its own bank but then public officials used them to finance their expenditures. In the 1990s, almost all state banks in Brazil were privatized and they put in place the Fiscal Responsibility Law in the year 2000 to avoid this situation at all levels of the administration (that is, federal and state and local).

Case 2. Delayed payment to public banks to “disguise a fiscal deficit”

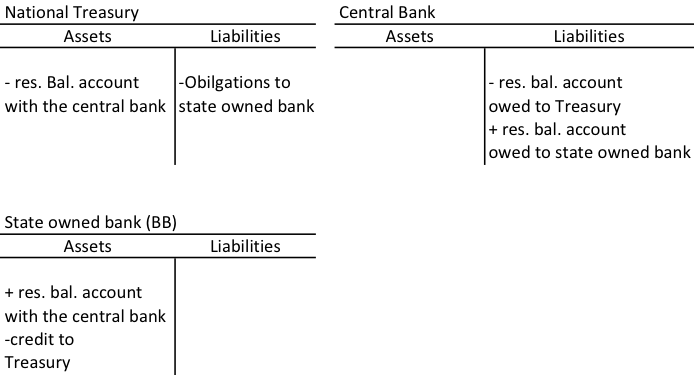

The Treasury eventually made payments to public banks using its account with the central bank

So, the Federal Court of Accounts (TCU) rejected the government accounting practices due to those delayed payments because they have classified this operation as borrowing by Treasury from public banks. However, the fiscal responsibility law says that the federal government cannot borrow “money” from public banks, only from private banks via bond issuance.

This misconception is based on the notion that sovereign governments have to borrow the currency from private banks at the market rate of interest, or else it would somehow be inflationary, since the federal government cannot spend by “keystrokes”. What did Federal Court of Accounts (TCU) miss? The monopoly issuer of the currency doesn’t need to borrow its own currency to spend (see more here Rezende 2009). Moreover, the conventional belief is that not borrowing or borrowing from public banks is somehow inflationary compared to borrowing from private banks!

The message is the following: the federal government can only borrow from private banks by issuing bonds (though technically an overdraft is not allowed even if extended by private banks).

But even in this case, they fail to recognize what a loan is, if a loan is a claim on the borrower’s assets then how is that, operationally, different from government bonds held by private or public banks? In both cases, they represent a claim on the federal government. They are promises to pay. But promises to pay what? The government’s sovereign currency. Who is the monopoly supplier of the currency? The federal government… Though there is a law that says that the federal government cannot borrow “money” from public banks, this is another example of a self-imposed constraint, it does not make sense when it is applied to a sovereign government like Brazil (Rezende 2009). The root cause of this misconception is based on the fallacy of composition, that is, the failure to distinguish federal government from other units such as state and local governments, firms, and an individual household.

Pingback: Links 4/7/16 | naked capitalism