By J.D. Alt

5. TREASURY BONDS—Are they really what we think they are?

Recall that in the old diagram we started out with—the one Congress seems to be using as a guide for its budgeting process—Treasury Bonds appear to be the mechanism by which the Federal Government “borrows” Dollars from the PS pot. Since we now understand that a Dollar is actually the Federal Government’s I.O.U. for tax credits, we can also see that it is illogical for the Federal Government to “borrow” these I.O.U.s. Why would it “borrow” its own I.O.U.—something it can instantly create any time it wants by simply saying, “I Owe You”? If that is the case, why does the FG “sell” Treasury Bonds?

Treasury Bonds play a big role in the Central Bank’s regulation of the Private Sector banking system, and also in the complex and arcane “method” by which the U.S. Treasury “spends” Dollars—but, for the purposes of our Diagram, we don’t need to deal with such trivia. All we need to understand is that, in fact, the Federal Government doesn’t really “sell” Treasury Bonds at all. To see this, we only need to review something we’re already familiar with: our own Bank Accounts.

As we know, there are basically two kinds of bank accounts: one kind of account we can withdraw Dollars from at any time, “on demand.” We can write a check, or we can find an ATM machine and exchange the “numbers” in our account for real Dollar Bills. As a general rule, banks pay us ZERO interest on these “demand” accounts. (In fact, they usually charge fees for our various transactions.)

The other kind of bank account is one which requires that we DO NOT remove our money for a specified period of time. These accounts are often called “certificates of deposit” or CDs. In exchange for our agreeing not to withdraw our money from the CD, the bank pays us interest. This arrangement is sometimes referred to as the bank “selling” us the CD, but everyone who has ever “bought” a CD knows that what is really happening is not the buying or selling of anything at all. Instead, we are simply taking some of the money out of our checking account (which doesn’t pay interest) and transferring it to another account (the CD) which does pay interest.

This, in fact, is exactly what is happening when the Federal Government “sells” a Treasury Bond. U.S. Dollars—whether they reside in a bank account or a wallet—do not pay interest. When a bank (or business, or person) “buys” a Treasury Bond from the FG, that bank or business or person is simply transferring some its financial wealth from Dollars (which pay no interest) into a Treasury Bond “account” which does pay interest. And the agreement is exactly the same as with the CD: In exchange for receiving the interest, you agree to leave your money in the Treasury Bond “account” for a specified period of time.

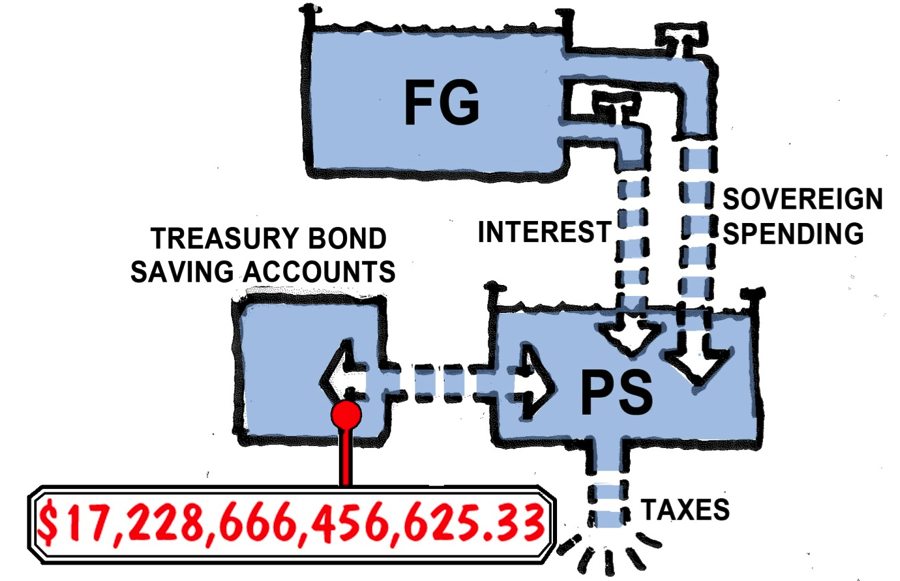

Viewed from this perspective, it is easy to see that one of the important consequences of the Federal Government “selling” Treasury Bonds is that a great number of Dollars are, in effect, “removed” from the PS pot! With this information, we can now add the second set of plumbing features to our new Diagram:

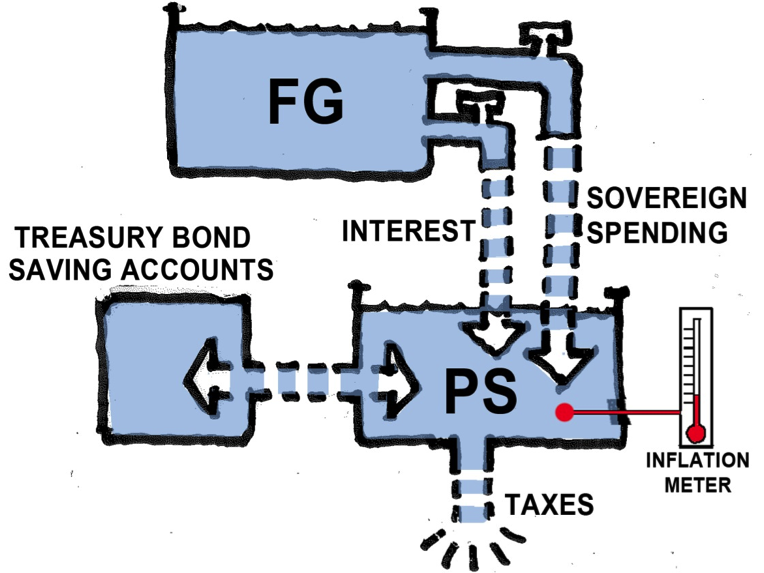

We have added a “Treasury Bond Account Chamber” which holds the Dollars that have been transferred into Treasury Bond “accounts” for a period of time. We have also added an “INTEREST” spigot to the FG pot—the Dollars paid as interest on the Bonds flows from this spigot into the PS pot. We can see that this plumbing arrangement, in effect, prevents a very large number of Dollars from chasing goods and services in the Private Sector economy—something that would push up prices (inflation)—and replaces those Dollars with a much smaller purchasing power (the interest payments.)

So our diagram now has two effective mechanisms for preventing the FG spending spigot from filling up the PS pot with Dollars to the point of overflowing (another way to visualize “inflation”—which we will now keep diligent track of with our “Inflation Meter”.) Theoretically, for a given amount of Sovereign Spending, we should be able to adjust the draining operations of Taxes and Bonds to keep prices under control.

It is worth noting that the “Treasury Bond Account Chamber” is also a very pleasing feature for citizens and businesses who happen to have a lot of excess Dollars. They are pleased because they can now trade their excess Dollars (which earn zero interest) for Treasury Bond “accounts” which provide them with a steady income that requires very little effort to “earn”.

6. QUESTION: Is the FG really a “Pot”?

One of the most striking features of the diagram we now have is that there are no Dollars flowing INTO the FG pot! Dollars flow out of the spending and interest spigots into the PS pot; Dollars drain out of the PS pot in taxes; and Dollars move back and forth from the PS Pot to the “Treasury Bond Account Chamber”. But the diagram shows no Dollars ever flowing into the FG pot. How can that be?

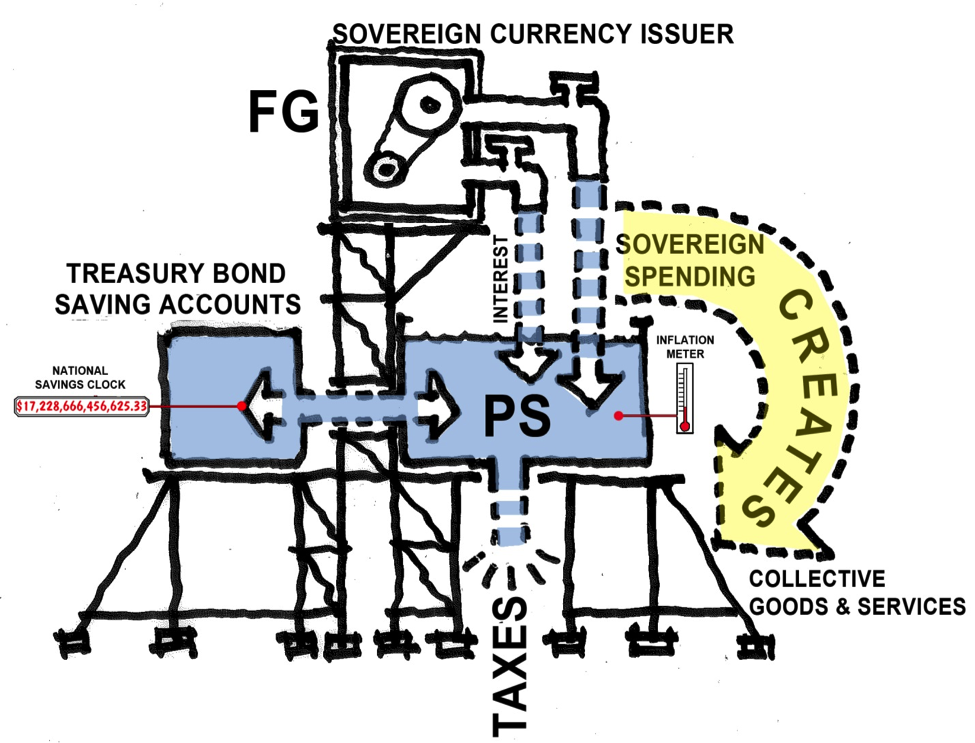

We already know the answer: A Dollar that flows into the FG pot can serve no logical purpose. The Federal Government doesn’t need that Dollar in order to have a Dollar to spend. For the sovereign to collect I.O.U.s to itself makes no sense. What we have been calling the FG “pot”, then, is not really a “pot” at all in the sense that something can be added to it—and we should modify our diagram slightly to avoid this potential confusion:

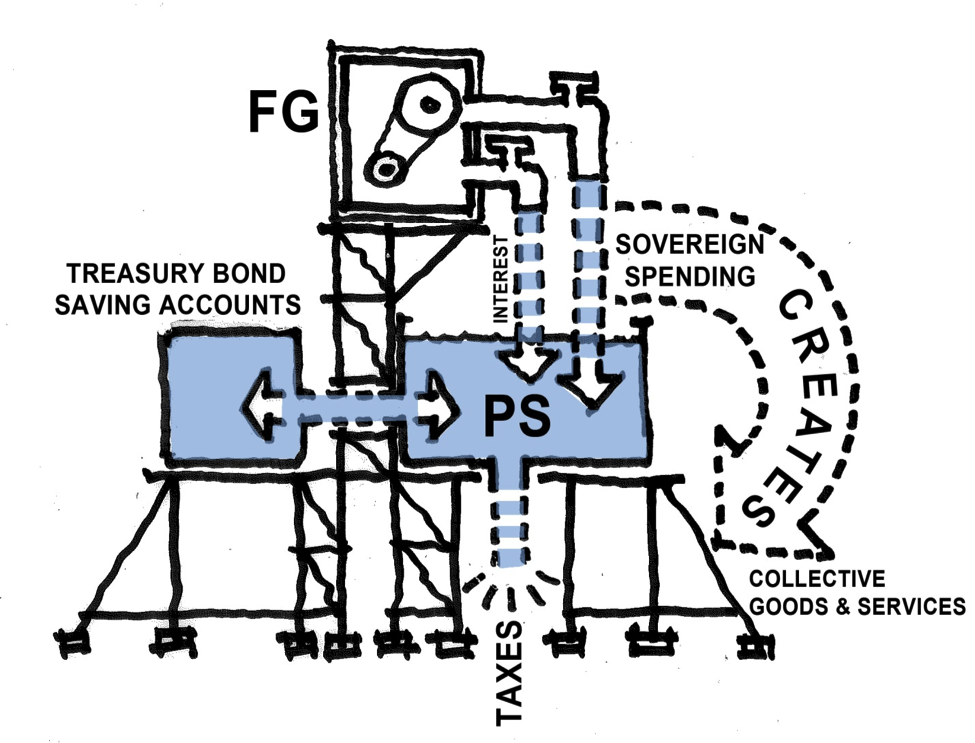

The FG “pot” has now been replaced with a “Sovereign Currency Issuer”. The SCI has only one function: to issue sovereign U.S. Dollars. You don’t have to put anything in the SCI (except paper, ink, and electricity to run the computer keyboards) to get Dollars out of its spigots. And this “machine” works—Dollars flow out of it as the Federal Government spends them—because we, the citizens, have agreed to the proposition that if we don’t pay our taxes with the Dollars the SCI produces, the FG then has the proper authority to put us in jail. At heart, it’s really a very simple (but dynamic) proposition.

7. The Most Amazing Coincidence

Let’s take a closer look at what is actually the most remarkable aspect of the diagram we now have before us—that is, the Sovereign Spending which flows out of the FG spigot. We now understand this Sovereign Spending is necessary to get U.S. Dollars into the PS pot where entrepreneurs and businesses then leverage them with bank loans to create goods and services, jobs and careers. What is amazing to contemplate, however, is that the initial Sovereign Spending of these Dollars also accomplishes something else: it creates goods and services that we benefit from collectively as a society—in many cases, that we benefit from substantially (as in: we might not even be alive without them.) In other words, the thing that drives our fiscal-monetary system coincidentally also makes it possible for us to build and create goods and services that make us collectively healthy and prosperous. The implications of this dynamic coincidence—when you actually “see” it—are astonishing, to say the least.

It’s important, then, that our new diagram somehow makes this most fortunate coincidence visible. I’d like to draw weather and GPS satellites, next-generation air-traffic control towers, fuel-cell powered bullet trains connecting city-center to city-center across the country, neighborhood health clinics, Home-Care providers in fleets of mini-vans filled with medicines and lasagna dinners, folding flood-gates around Manhattan and Norfolk, neighborhood Early-Reading Centers manned (and wommaned) with teachers trained and focused exclusively on teaching kids to read, renewable-energy electric grids that make fracking and transporting toxic waste-water completely unnecessary—but that would break the age-old rules of architectural diagramming: Keep it simple and symbolic. So I’ll do it like this:

What I’ve added is just a visual gesture indicating that the result of Sovereign Spending is the creation of something that “supports” the Private Sector pot itself—holds it together, keeps it from falling apart and rolling down the hill.

The important thing to understand about this “support” structure—whether it is services we provide ourselves (e.g. medical care), or structures and technology we build for our collective benefit (e.g. charging-station networks for electric vehicles)—is that what can be accomplished is not limited by the number of Dollars available for Sovereign Spending. The limitation, instead, is imposed by the real resources—labor, materials, energy, and technology—which are sustainably available to implement our collective goals.

8. The Right Words—a diagrammatic necessity

There’s only one thing left to make our new diagram useful for guiding the design of an informed and constructive National Budget. We need to decide on the proper terminology we’ll use to talk about—and measure—the flows that are occurring in the new diagrammatic plumbing. If we use the wrong words, or if someone uses one set of words and somebody else uses another, there could be a lot of confusion and misunderstandings. So a consistent and accurate “diagram terminology” is important.

For example, we might want to talk about (and measure) the number of Dollars that are proposed to flow, in a given budget year, from the FG spigot into the PS pot—and compare that to the number of Dollars that are drained out by taxes in that same year. In the old diagram (the one Congress is still struggling to use) the difference between what the FG spends and what it “collects” in taxes is called “The Deficit”. It would be called a surplus if the FG “collected” more in taxes than it spends, but since that rarely occurs, this measurement is almost always called “The Deficit”—and the FG spending that occurs beyond what is “collected” in taxes is called “Deficit Spending”.

“Deficit Spending” is a very powerful and frightening term. It conjures up the idea of digging a hole you can’t get out of. Indeed, that is precisely the dilemma the old diagram poses. It’s intuitively obvious to everyone in the PS pot—all the households, businesses, state and local governments—that if they spend more money than they take in, the hole that deficit spending creates has to be filled back in (or the households, businesses, state and local governments will be forced into bankruptcy.) In our new diagram, this reality remains unchanged—inside the PS pot.

But the new diagram also makes it clear that when the “Sovereign Currency Issuer” issues and spends more Dollars than are drained in Taxes, it is not digging a hole at all. There is no need—and, indeed, it is not even possible—to put replacement Dollars back into the “Sovereign Currency Issuer”! How can that be?

Again, it’s because of the underlying reality of what a Dollar actually is. Here it is, one more time: A U.S. Dollar is an I.O.U. issued by the sovereign U.S. government which says, “I owe you one Dollar’s worth of credit on the Federal Taxes you owe me.” Because the FG doesn’t have to “earn” Dollars (or anything else) in order to fulfill this promise as many times as necessary, by logic it can never have a “deficit” of its own I.O.U.s. In contrast, all of us who use those I.O.U.s for “money” (all U.S. citizens, businesses, state and local governments, for example) must earn them, or borrow them, before we can spend them. This is true for the simple reason that we are “users” of the money, rather than the “issuer” of it.

So the new diagram makes it clear that if the FG spends more Dollars than it drains in Taxes, it is inaccurate and misleading to call the difference a “deficit”. The FG is not deficient in anything at all! There is no hole that someday has to be filled back in. The calculation we are now trying to name is nothing more than the simple accounting of the number of Dollars, in a given budget-year, the FG issues and spends into the PS pot minus the number of Dollars the FG drains out of the PS pot when those Dollar “I.O.U.s” are presented (and cancelled) as tax payments.

Before trying to think of a more accurate and less confusing name for this calculation, however, we should consider an important question: What is the result if Congress actually succeeds in achieving its on-going aspiration to create a “balanced budget”—or even the holy grail of a “budget surplus”? The old diagram clearly begs for this goal—if the FG could just manage to create a budget that enabled it to collect more tax Dollars than it needs to spend, then the Federal Government would, at last, be “fiscally responsible” and not have to “borrow” all those Dollars to make up its shortfall!

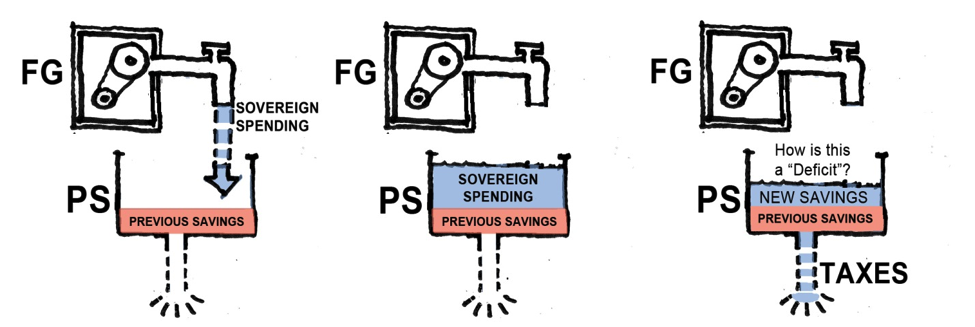

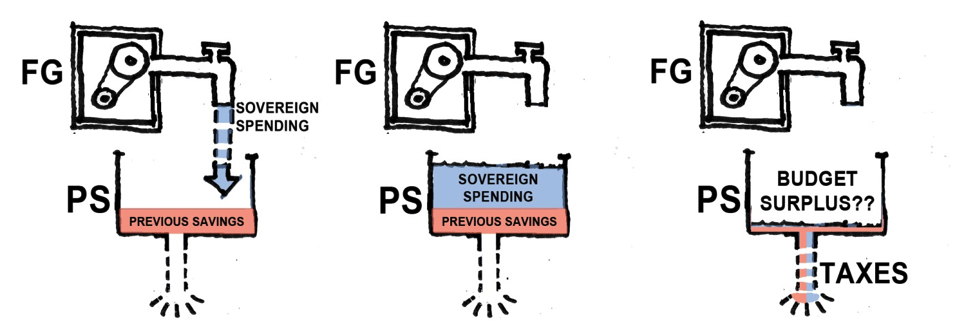

But our new diagram reveals the remarkable folly of this perspective when a sovereign government is its own “currency issuer”. Here are a series of simplified “plumbing flows” showing each of the conditions we’ve discussed: A “budget deficit”, a “balanced budget”, and a “budget surplus”. In each case, the diagrams begin with the Private Sector pot containing the net Dollars (savings) left over from the previous budget-year cycle.

In the first diagrams (“budget deficit”) we can see that, in the given budget-year, the FG has drained out fewer tax Dollars than it has spent into the PS pot. The result is that the Private Sector retains an additional net savings of the Dollars the FG has spent. Those Dollars can be literally “saved” if they are put in Certificates of Deposit at a bank, or transferred into Treasury Bonds—or they can be invested in new business ventures. In either case, the net Dollars remaining in the PS pot are an expansion of the financial “wealth” of the Private Sector in general. Why would we want to call that a “Deficit”?

In the second series of diagrams, Congress has finally achieved its “balanced budget”. It has, for the given budget-year shown, drained out of the PS pot the same number of Dollars (in taxes) that it has spent into the PS pot. The result? The Private Sector, in that budget-year, has ended up with zero new net savings. In general, the financial “wealth” of the Private Sector is the same as it was at the beginning of the budget-year. The only logical reason the FG would want to constrain that wealth would be if price inflation had become a threatening condition in the PS pot. Otherwise, the “balanced budget” simply imposes an austerity on the Private Sector without rhyme or reason.

In the third diagram, our Congressional leaders have achieved what they believe to be their greatest goal: a “budget surplus”! They have actually managed to spend fewer Dollars into the PS pot than they have drained out in taxes. But what they view as a “surplus” is actually a net deficit for the Private Sector: at the end of the budget-year, the PS pot actually has fewer Dollars than it started out with. The result? In order for the Private Sector households and businesses to maintain what had been their current level of expenditures (their “lifestyle” so to speak) it becomes necessary for them to spend their savings from the previous budget-years–or to borrow bank Dollars to make up the difference. If Congress runs a “budget surplus” for long, the Private Sector will either have to diminish its economic activity in general (go into recession)—or plunge hopelessly into debt (borrowing bank money it can’t repay, possibly causing a banking crisis)—or both.

The idea, then, of looking at the difference between what the FG spends and what it drains in taxes in terms of “deficit”, or “balance”, or “surplus”—and using those terms to somehow guide our national budget-planning process—is clearly not a functional view of reality. Applied to a sovereign “money Issuing” government, which is creating and issuing its own tax I.O.U.s, the terms are completely meaningless. Worse than meaningless, these terms create an intuitive misunderstanding that can do (and has done) irreparable harm to both our collective good and the private well-being of tens of millions of real American citizens.

9. Let’s call it: “Net Spending Achievement”

My first attempt at a more useful term for describing the difference between what the FG plans to spend in a given budget-year, and what it plans to drain away in taxes, is “Net Spending Achievement”. Economists may not like it much but, as an architect, I find this phrase appealing for the simple reason that it strongly suggests the purpose of Sovereign Spending, first and foremost, is to actually build something concrete and useful for our collective good. The emphasis of the phrase is not numerical but visionary. The actual “net number of Dollars” spent is unimportant (unless price inflation is a problem). What is important is what we actually decide and agree to achieve with that spending.

Please imagine, for a moment, how our political discourse might change if everyone understood the discussion was no longer about the size of our national “budget deficit” but, instead, was about the concrete goals of our annual “Net Spending Achievement”. This is what our new diagram is asking us to do.

10. Do we really have a “National Debt”?

We won’t attempt to re-vocabularize all of conventional economics, but there is one term our new diagram clearly begs should be reconsidered: the “National Debt”. This term competes aggressively with “National Deficit” to sow confusion and chaos in our Congressional budgeting process. Evidence of this confusion is a digital “clock” on Sixth Ave. in Manhattan (it used to be on Times Square) that tallies up, in real time, the U.S. Dollars which are transferred from Private Sector “Dollar” accounts into Treasury Bond “accounts” paying interest. The accumulating number is staggering (which is why, of course, the clock is such a novelty)—and terrifying, because it appears to measure (using the old diagram Congress seems hopelessly stuck with) the number of Dollars the Federal Government has borrowed to make up its “shortfall” in tax collections. Here’s what the “clock” reads as of today:

Followers of this “clock” like to take this number and divide it by the U.S. population, generating the share of the “National Debt” each private citizen will, some day, have to repay—currently: $54,293.48. (And it keeps going up!) How is each of us ever going to manage to pay that off? How could the U.S. Federal Government even think about borrowing that much money? Panic in the streets!

If we take this “clock”, however, and insert it in our new diagram, we can see it is actually measuring something quite different than what the “National Debt” perpetrators lead us to believe.

As we can see, there is no logical place to connect the “clock” other than at the flow between the PS pot and the “Treasury Bond Account Chamber”. The “clock”, then, is actually measuring the number of Dollars in the PS pot which have been transferred from a “Dollar” account (which pays no interest) to a Treasury Bond account which does pay interest—in exchange for the pledge that those Dollars will be kept tucked away in the Bond account for a specified period of time.

After the agreed upon time period, the Dollars are simply transferred back to the “Dollar” account in the PS pot from which they came. In most cases, what happens next is that the owners of those Dollars want to “roll” them back into the Treasury Bond account (as quickly as possible) so they can continue to draw their “free” interest payments from the FG spigot.

The “clock” then, is not measuring “borrowed” Dollars that have to be “repaid” or “replaced” in any logical sense of those terms. It is simply measuring the real financial wealth which U.S. citizens, businesses, state and local governments have moved into a savings account (Treasury Bonds) at the Sovereign Central Bank. Semantic logic, therefore, would have us give it a new name: It is, in fact, the “National Savings Clock”!

Now when New Yorkers walk down Sixth Ave., rather than panic at the financial hole they’re in, they can actually feel a sense of security at the enormous wealth they have collectively earned and saved.

If you’re concerned the FG still has to pay interest on all those saved Dollars (which it does) just remember that those interest payments are simply made with Sovereign Tax I.O.U.s which the Federal Government has an infinite supply of—and remember, too, that the net result of this savings and interest operation is to prevent trillions of U.S. Dollars from chasing goods and services in the PS pot (which helps control price inflation.)

11. Why we should LOVE our new diagram

So there it is: an architect’s attempt to draw a diagram that might be a more constructive guide for our National Budgeting process than the diagram Congress is currently struggling to make work. It may look like a Rube Goldberg machine (architectural diagrams—especially ones visualizing flows—tend to have that flavor) but the National Budget “edifice” it makes possible is quite remarkable. To summarize, what the diagram is showing us….

- We do NOT want a “balanced” budget—or, even worse, a budget “surplus”! What we want (as long as price inflation is under control) is the largest and most effective “National Spending Achievement” we can envision.

- The “achievements” we can realize are NOT limited by how many Dollars are in the U.S. Treasury, because the U.S. Treasury literally has an infinite number of Dollars to spend (as long as price inflation is under control).

- The “achievements” we can realize are limited ONLY by the real, sustainable resources (labor, materials, energy, technology) which are actually available in exchange for the Sovereign Spending.

- “Entitlement” and “Discretionary” budgets do NOT have to compete with each other for a fixed pot of Dollars. As long as price inflation is under control, whatever Dollars are necessary can be allocated to the “National Spending Achievement.”

- The U.S. Federal Government will never have to—or, indeed could it—“borrow” U.S. Dollars from China. Like anyone else who holds a zero-interest bearing Dollar, the Chinese can transfer their Dollars into Treasury Bond “accounts” that will pay them interest—but, as we now understand, the FG is not “borrowing” those Dollars from China or anybody else!

Finally, in contemplating our new diagram, the most astounding and empowering thing to “see” is that while it remains emphatically true that we, as individuals, are financially constrained by the finite number of Dollars each of us can earn and save—as a collective society, working and cooperating together, we have all the financial resources necessary to pay ourselves to accomplish virtually anything we are capable of. This, in the end, is the astonishing “truth” that will solve the “unsolvable” dilemma of our National Budget.

Pingback: DIAGRAMS & DOLLARS: modern money illustrate...