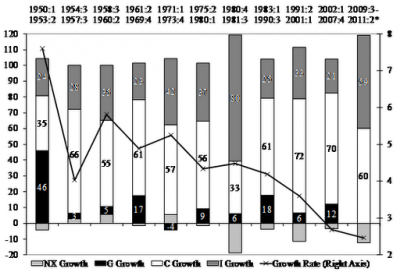

The new BEA figures about economic activity continue to point to a replay of a Japanese-style lost decade or, even worse, a 1937 scenario. The current expansion has been the weakest on record since World War Two and the trend since the early 1980s does not provide much comfort. Figure 1 shows that each economic expansion since the 1980s has been weaker and weaker and the rate of decline has accelerated.

The current debate in Washington does not provide any comfort for the short run or the long run with both political parties willing to jeopardize whatever economic growth we have left over a fictitious ceiling that serves no economic purpose. All this suffering is supposed to help in the long run because of the good that will come from “reforming” (read “dismantling”) pillars of economic progress like Social Security.

The 2009 Obama “stimulus” is long gone and all levels of government negatively contributing to economic growth. Since the third quarter of 2009, the contribution of the government to economic growth has been nil on average.

|

|

Figure 1. Economic growth and its sources

Source: BEA (NIPA Table 1.1.2), NBER.

Note: Last period is an on-going expansion.

|

All this provides one more clue that the current large deficits have nothing to do with government spending running wild. This also provides a clue about how little has been done in terms of productive spending by the government since the beginning of the expansion. Most of the help provided by the government was to hopelessly insolvent institutions that should have disappeared from the face of the earth a long time ago.

10 responses to “Where is the “Recovery”? Where Did the “Stimulus” Go?”