By William K. Black

(cross-posted with Benzinga.com)

When Reputation becomes Ineffective or even Perverse

Control fraud also makes reputation perverse. Theoclassical economists predict that reputation trumps everything, even auditors’ conflicts of interest. This prediction has repeatedly been falsified by reality. The asserted reputational trump ignores crippling errors. Several theoclassical assumptions about reputation and fraud are implicit and interrelated. Implicit assumptions pose the greatest risk of error because the people making the assumption never had to defend the unstated assumptions. Reputation and fraud turn out to have an important, and complex, relationship. One cannot understand reputation without understanding fraud techniques. Common theoclassical assumptions, most of them implicit, about fraud and reputation include:

• An individual has a consistent set of behaviors that drive his reputation

• The public’s perception of an individual’s reputation is accurate

• Members of the public have a consistent perception of an individual’s reputation at any given time

• A good reputation can only be achieved through consistent good deeds

• Fraud is discovered because of its very nature

• Fraud is discovered because of “private market discipline”

• The people who lead frauds are discovered

• The people who lead frauds are sanctioned so that fraud does not “pay”

• All other market participants that might deal with the entity will learn promptly that it has engaged in fraud

• Other market participants will not aid or permit fraud by another party

• Other market participants will not deal with an entity with a reputation for acting fraudulently even if the entity has not (yet) defrauded those market participants

• The people who lead frauds suffer disabling damage to their reputation that makes it impossible for them to commit future frauds even if they are not sanctioned

• Elite financial firms and independent experts will not commit, aid, or permit frauds because of their interest in their reputations

• Elite financial firms and independent experts would lose their valuable reputations if they committed, aided, or permitted frauds

• The least likely persons to commit frauds in elite institutions are their senior leaders

• When CEOs set a “tone at the top” that tone emphasizes integrity and reputation

White-collar criminologists have found that each of these assumptions is unreliable. Economists rarely study fraud or read the criminology literature, yet they often have powerful ideological “priors” about fraud. Easterbrook & Fischel (1991), the deans of applying law and economics to the study of corporate law, exemplify each of these characteristics. They assert that “a rule against fraud is not an essential or … an important ingredient of securities markets.” That assertion is remarkable for its certainty, lack of exceptions, and certitude. It would be wonderful if the assertion were true. Fraud, one of history’s great scourges, would (like polio) be eradicated. Financial markets would be efficient. Bubbles would be much rarer and far less severe. Unfortunately, the assertion is also unsupported and unsupportable. Fischel was an expert for three notorious control frauds during the S&L debacle, where he employed the theories he and Easterbrook would soon write about in their 1991 treatise containing their remarkable assertion.

Individuals, entities, society, and market participants are all far more complex than theoclassical economists assume. It is normal that the same person is perceived differently by every person with a perception, and those differences can be polar. “Fraud” is one of the most variegated of activities. One common characteristic, however, is that fraudsters do not rely on fooling everyone. Many successful frauds, such as the Nigerian “419 frauds”, are obvious to nearly everyone, but “nearly” universal detection of the 419 frauds is not sufficient to prevent them from being profitable. Fraud detection is rarely universal because people vary in their susceptibility and because detection by one person typically fails to spread to most people.

When most people, including economists, think of “fraud” they generalize from what they know from personal life. Nigerian 419 scams, most things advertised on cable television after 10:00 p.m., and con jobs shown on television dramas are what the general public thinks of when they consider “fraud.” The nature of these frauds typically leads the victim to discover (albeit too late) that he has been defrauded. Victims of 419 frauds send “fees” or make “deposits” and do not get the $40 million in funds that the late oil minister allegedly stole from the Nigerian government. The “debt counseling” service charges its victims fees, falsely claims that one need no longer pay one’s creditors and leaves its victims even more insolvent.

These frauds, if they succeed, almost certainly will be discovered by the victim. (There are important exceptions – many fraudsters prey on victims suffering from the earlier stages of Alzheimer’s, those who are functionally illiterate in English, or are incapable of understanding financial matters. Fraudsters profit from their selective reputation with their peers as criminals by selling their mailing lists of vulnerable victims to other fraudsters.) The fraudsters who run the 419 and debt counseling scams know that most of their victims will become aware that they were defrauded. The fraudsters also know that they can continue to defraud others even though the victims learn that they were defrauded and even if the government closes their business. Entry is exceptionally easy for each of these common frauds. If the government shuts down a debt counseling scam it can create a new name and be in operation again within a week. If the fraudulent CEO were banned from the industry he would recruit someone to serve as his “straw” and be back in operation within a week.

Victims of some common, unsophisticated frauds typically do not discover that they have been defrauded. The classic example is the scam drug that promises to enlarge the penis. The victim buys the drug. He is desperate for the drug to work. It is easy for the victim to believe that the drug is working. The alternative is to feel inadequate, hopeless, and made a fool of by a con. This fraud illustrates a key point; an “unsophisticated” fraud can be highly successful because it rests on an insightful understanding of human nature and vulnerabilities.

Accounting control frauds closely approximate the perfect crime. To be a nearly perfect crime a control fraud must reduce the risks of regulatory and prosecutorial sanctions. They are normally not identified as frauds. Even when they are identified as frauds they are normally not sanctioned. Instead of destroying the CEO’s reputation, accounting control fraud normally creates the CEO’s undeserved reputation as a “genius.” This is a subject deserving of extended treatment in future columns, so I will only summarize the key points here in the context of mortgage lending.

• Everyone is reluctant to view a seemingly legitimate lender as a criminal enterprise

• The fraudulent CEO increases this reluctance by mimicking many corporate mechanisms

• No overt conspiracy is required – the CEO creates the perverse incentives and uses his ability to hire, promote, compensate, discipline, and fire to ensure that the recipe will be implemented at the firm and by its loan brokers and that the independent experts will bless the fraudulent valuations and loss reserves

• The CEO can quickly convert large amounts of firm assets to his personal benefit –sufficient to make him wealthy – through seemingly normal corporate compensation mechanisms driven by the record (fictional) income generated in the short-term by employing the recipe

• If there is a bubble, particularly one hyper-inflated by an epidemic of accounting control fraud, then the lender’s bad loans can be refinanced and the record income created by the recipe can be continued beyond the short-term

• The firm fails eventually, but a CEO can always offer a non-fraudulent explanation for a bank failure. This is particularly true when an epidemic of accounting control fraud hyper-inflates a bubble and triggers a severe recession.

Control frauds exploit “agency” problems in order to turn reputation perverse. The Big Four audit firms do have a substantial financial interest in their reputations. The Big Four audit firms are able to charge far more for their audits than can second tier firms. Unfortunately, the more valuable the audit firm’s reputation the more value the audit partner can extract by “selling” that reputation by blessing an accounting control fraud’s financial statements. White-collar criminologists have found that the theoclassical assumptions about top tier audit firms are false.

The most elegant frauds typically signal multiple, conflicting reputations to different actors. The reason a control fraud is so dangerous is that it is a criminal enterprise that appears to be a legitimate enterprise. Indeed, the fraud recipe makes it appear to be an “alpha” bank – exceptionally profitable while suffering few losses despite making highly risky transactions. The CEO who can pull off that impossible trifecta quickly develops a reputation as a “genius.” (He, of course, controls a PR department with essentially unlimited funds that is dedicated to feeding his ego – fraudulent CEOs are human and do not live by yachts alone.)

Obtaining a stellar reputation is one of the greatest attractions of fraud to the C-suite. The portion of C-suite officers who are actually geniuses is vanishingly small. But any C suite officer should have the competence to engage in accounting control fraud. The recipe is straightforward and making huge numbers of bad loans is vastly easier than making huge numbers of good loans. Accounting fraud is a sure thing for a lender. It is a strategy guaranteed to make you wealthy and create a reputation that you are a genius. The desire to attain and retain a highly positive reputation is one of the major contributors to fraud. The best way to become a CEO is to find an industry optimal for control fraud. One of the factors that makes an industry more criminogenic is ease of entry. Anyone with modest net worth could start a mortgage brokerage and become its CEO. States like Florida did not even check if the new CEO had a criminal record. The newly minted CEO could transform himself from a crook to CEO and by following the recipe he could make himself wealthy and gain a positive reputation.

Consider how reputation works when the fraudulent CEO interviews a potential CFO. The CEO wants the CFO to appear to most outside actors to be honest and competent. He wants the CFO to actively assist the accounting fraud by implementing the four-part recipe enthusiastically. The CEO will not hire the applicant unless the CFO-wannabe signals that he is actually a person deserving of a poor reputation for integrity. Once the CFO is hired he may interview the partner at the Big Four audit firm who is seeking to be selected as the audit partner. The CFO of an accounting control fraud and the prospective audit partner will send contradictory signals during the same interview. On one level, they play roles that seem to epitomize professionalism. On another level they carefully send coded signals. The result is effective communication. The control frauds rarely fail to receive clean opinions for fraudulent financial statements even when the bank is massively insolvent, makes hundreds of thousands of fraudulent loans, and violates scores of accounting principles. The control frauds rarely have to fire the audit firm or audit partner. The control frauds do not have to bribe the audit partner, appraiser, or credit rating agency to get them to bless their frauds.

CEOs have their wealth, income, and reputation invested in “their” company. When it is about to fail they may adopt accounting control fraud as a tactic to delay the failure. This is known as “reactive” control fraud.

A fraud I’ve discussed, the Nigerian 419 scam, illustrates another aspect of how frauds manipulate reputation. Consider the multiple levels of reputation involved in this unsophisticated scam. The perps are frauds and deserve a reputation for fraud. To their neighbors, however, they may appear to be honest and have a positive reputation. The perps create a fake identity (e.g., I am the daughter of the late oil minister of Nigeria). The fake identity they construct is that of a corrupt individual of terrible reputation. The paradoxical reason that they construct this terrible reputation is to convey trustworthiness to the victim. You can trust them because they are desperate for your help. They cannot proceed lawfully because they are trying to rip off the Nigerian government. Their message is that there is honor among thieves as long as they need each other. The perps, in turn, are trying to defraud Americans who signal by their responses that they are devoid of integrity and clueless about fraud schemes. If poorly educated, only partially literate Nigerians can understand a subset of Americans that well, think how sophisticated a fraud scheme our elite business school graduates can devise with the aid of a vastly superior weapon of fraud – control of a seemingly legitimate bank.

The CEOs that controlled the fraudulent banks burnished their reputations both to stoke their (and their spouses’) egos and to make it harder for anyone to perceive them as criminals. There are three sure means for CEOs to enhance their reputations. Reporting that your bank earned large profits is certain to prompt praise by business reporters. Causing the bank to make large charitable contributions, which the CEO is credited with providing, is sure to improve one’s social standing. Causing the firm, and its senior officers to make large political contributions is likely to improve the fraudulent CEO’s social standing and political power.

Epidemics of Accounting Control Fraud Hyper-inflate Bubbles

Epidemics of accounting control fraud are not rare. White-collar criminologists use the metaphor that accounting is the “weapon of choice” among financial control frauds. The “ammunition of choice” varies depending on the industry and time period, but it has common characteristics. The ideal asset with which to “load” a lender’s accounting control fraud weapon:

• Lacks a readily verifiable market value

• Has a higher nominal yield

• Can be structured to delay delinquencies and defaults

• Can be sold or retained in portfolio

• Can be refinanced to further delay delinquencies and defaults

• Can be made without documenting that the borrower is uncreditworthy

These characteristics mean that accounting control frauds’ investments are likely to be “lumpy” instead of evenly distributed in many loan categories. Fraudulent lenders are likely to grow overwhelmingly through a few forms of lending that make the most destructive “ammunition.”

When control frauds cluster in a particular asset category they inherently threaten to inflate a bubble. The recipe ensures this for it both requires extreme growth and makes the extreme growth possible – there are tens of millions of potential borrowers who lack the clear capacity to repay the loan.

Lending is often lumpy geographically and scale matters for bubbles. If fraudulent lenders are more active initially in some communities the local bubble becomes self-reinforcing. As the local bubble inflates it becomes easier to attract uncreditworthy borrowers who can hope that rapidly inflating home prices and non-existent underwriting mean that they can qualify for a loan to purchase a house; “flip” the home, and use the profit to be able to afford to purchase a home. Speculators will enter the market and buy multiple homes. They also plan to “flip” the homes, but their goal is profit. Other nonprime lenders will enter the market and mimic the initial frauds’ operations in order to obtain the record “profits” and bonuses. Large numbers of mortgage brokers will start operations and grow rapidly to feed the mortgages to the fraudulent lenders. The greater the fraudulent lenders’ growth rates relative to the size of the local housing market, the faster and greater the local bubble inflates. The bad loans are easily refinanced to minimize reported losses. The result is record reported income and the creation of hyper-inflated local bubbles.

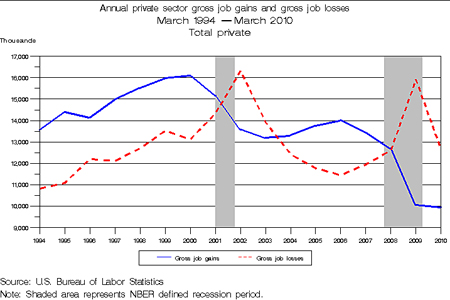

Hyper-inflated bubbles pose systemic risks. They misallocate extraordinary amounts of assets for up to a decade. Markets are intensely inefficient and move ever farther from efficiency. The fraud recipe for maximizing a lender’s reported income actually maximizes losses. This causes massive bank failures and serious losses of employment – producing severe recessions. From a regulatory perspective, hyper-inflated bubbles are particularly dangerous because they can destroy honest banks that had large residential real estate loan portfolios before the bubbles hyper-inflated. If housing market prices drop by 50% in a metropolitan area every portfolio lender is likely to fail. (The frauds, of course, are the villains, but they claim to be victims of the bubble’s collapse.)

Regulating to Counter Accounting Control Fraud Epidemics by Mortgage Lenders

Reducing Crime v. Redirecting Criminals

One of the good news/bad news aspects of criminology is that it is far easier to redirect crime than to reduce it. When I lock my car I don’t make it very difficult to steal. A professional can steal it in roughly 15 seconds. Nevertheless, locking my car materially reduces the risk that my car will be stolen. Defeating my lock requires a tool and some suspicious behavior on the part of a professional and many cars are stolen by amateurs. When I lock my car I redirect potential thieves towards easier prospects but I don’t reduce overall car theft.

The good news arising from this discussion of redirecting crime, from the perspective of any particular regulatory agency’s leaders’ reputation, is that he doesn’t have to do all that much to reduce dramatically the risk of an epidemic of accounting control fraud among banks regulated by his agency. If he is materially tougher than other banking regulators he may still face some reactive control frauds among failing banks, but most opportunistic control frauds should choose to have their banks regulated by weaker supervisors.

The supervisory steps that the stronger regulator could take that would best redirect control frauds are not esoteric – they are precisely the measures that a competent banking regulator would put in place. We can determine the steps that would be most effective in preventing a criminogenic environment by considering the implications of the four-part accounting control fraud recipe. Preventing extremely rapid growth, preventing the making of very large amounts of bad loans, preventing extreme leverage, and requiring appropriate loss reserves would all reduce greatly the fictional income reported by and the real bonuses paid to the bank’s controlling officers. (Directly restricting large bonuses to long-term income would be even more effective, but no American banking regulator was willing to even consider doing so prior to 2010.)

Making entry into the industry more difficult would be particularly effective in redirecting control fraud epidemics. The regulatory agency could also make its industry far less criminogenic by being more vigorous in examining and supervising, bringing administrative enforcement actions and civil suits, and by making criminal referrals and working with law enforcement to make prosecutions of senior bank officials engaged in fraud a priority.

Two classic examples of redirection (and the importance of regulatory black holes and ease of entry) arose when I was an S&L regulator. FDIC savings banks suffered lesser losses than S&Ls during the mid-1980s in substantial part because the FDIC’s tougher regulation and supervision meant that the opportunistic frauds entered the S&L industry in 1982-84 rather than the FDIC-regulated savings bank industry.

In 1990-91 the West Region of the Office of Thrift Supervision cracked down on liar’s loans, which were becoming significant among a number of California S&Ls. We recognized that such loans were often fraudulent and inherently unsafe and unsound. Long Beach Savings responded to this supervisory crack down by giving up its S&L charter and becoming a morgage banker to escape our jurisdiction. It changed its name to Ameriquest and became an infamous predatory lender specializing in nonprime lending. One of its leading nonprime competitors was owned and managed by a family that we had forced out of the S&L industry.

Redirection may be part of the explanation of why Canada had fewer problems with its mortgage lenders than the U.S. did during the recent crisis. Mortgage fraud became endemic in the United States due to the operation of the accounting control frauds, but mortgage fraud and accounting control fraud among Canadian banks are reported to be unusual. Two cautions are in order. First, supervision can be so weak that the regulators routinely cover up the control frauds. I do not think that is the case in Canada. Second, Canada did not engage in the radical deregulation and desupervision that the U.S. did. A Canadian of poor integrity and modest wealth could found a loan brokerage firm in Canada or 50 miles away in the United States. Canada may have redirected many of its wannabe banking frauds to the United States.

Our challenge as regulators should be to reduce the frequency and severity of epidemics of accounting control fraud rather than merely redirecting them to another industry or region. In the context of residential mortgage lending, that means that all residential mortgage lenders should be subject to federal regulation for safety and soundness.

A Recipe for Regulatory and Industry Success

Liar’s loans were bad for mortgage lenders, borrowers, and the nation. Effective regulation would have been aided all three groups. Fortunately, we have known for at least a century how to make safe residential home loans. The following rules and laws should be mandatory for residential home lenders:

• Home loans must be fully underwritten

• The minimum requirements of full underwriting – verification of income, employment, credit history, down payment, etc are specified

• The verified underwriting must be contemporaneously documented and the lender must maintain that documentation

• Home loans must be made on the basis of full appraisals

• It is unlawful for any person to inform the appraiser of the loan amount prior to finalizing the appraisal

• It is unlawful for any person to intimidate or bribe or attempt to intimidate or bribe an appraiser in the regard to a real estate appraisal

• It is unlawful to for any private entity to base any aspect of a loan officer or agent’s compensation on the basis of the volume of loans presented, originated, or approved rather than on the quality of the loans

• All residential home lenders are made subject to the regulations that currently mandate that federally-insured institutions file criminal referrals (Suspicious Activity Reports (SARs)) in the circumstances described in those regulations

• The residential home lender must review each outside appraisal for compliance with appraisal standards

• Teaser rates are prohibited

• All borrowers must be underwritten to establish their ability to repay the loan fully at the fully indexed rate without refinancing the loan and without assuming any appreciation of the home

• All home lenders will take steps to check, prior to lending, whether the borrower owns multiple homes and is representing that more than one home will be his principal dwelling

• I will address in future columns documentation maintenance necessary to end the pervasive problems with fraudulent foreclosures and lost or non-existent documents

In addition to these underwriting and documentation reforms, the regulators need to take broader approaches to be effective. First, the staff and leadership need to be trained in accounting control fraud techniques. For example, only fraudulent lenders deliberately inflate appraised values (or permit them to be inflated). Regulators need to understand that when they identify that practice they have identified a fraud that must be stopped urgently. I asked the question years ago in an academic article – why doesn’t the SEC have a “Chief Criminologist”? I made clear that I was only using the SEC as an example of the many agencies whose duties include civil law enforcement. We have seen the catastrophic cost of regulatory ignorance of fraud techniques.

Second, the entire regulatory and law enforcement partnership that proved so successful in responding to the S&L debacle must be reestablished and it must replace the FBI’s “partnership” with the Mortgage Bankers Association – the trade association of the perps. The regulators need to play a critical role in training the FBI agents and Assistant U.S. Attorneys (AUSAs) to identify and investigate accounting control frauds (a capacity that as I’ve just described the agencies will have to rebuild). I’ve described in prior articles how only the regulators can fill the vital role as “Sherpas”, the virtual cessation of the regulators making criminal referrals, and the failure to create any analog to the “Top 100” prioritization effort, so I will not repeat the details in this column.

Third, the agencies must end the “Reinventing Government” mantra that the industry is the regulators’ “customer.” Our only customer is the people of the United States of America. We provide unique benefits to honest banks precisely because our function is not to make bankers happy. Our function is to be skeptical, to speak truth to power, and to be courageous and vigorous against the frauds. To be successful the regulators must think of themselves as the regulatory cops on the beat whose primary function is to see that cheaters don’t prosper. By cracking down on the cheaters we make it possible for the honest bankers to prosper.

Fourth, the regulators need to understand what makes an environment criminogenic and make the prevention of such environments their top priority. This requires a very different way of thinking, particularly for regulators who have drunk deeply of the anti-regulatory ideologies. Executive compensation is typically perversely weighted heavily towards short-term reported income. This not only prompts fraud, but also provides the means of looting. Since the crisis, executive compensation has become even more perverse. Size matters. If the executive compensation for meeting extreme short-term income targets is very large, one year’s compensation can make the CEO wealthy. The fraud recipe makes attaining even extreme short-term income targets a “sure thing.” Every bank CEO can be a genius – for two-to-eight years depending on the size of the bubble.

Compensation for professionals is also perverse and criminogenic. As long as the CEOs get to hire the “independent” professionals they will not be independent. When the bank CEO is a fraud the professionals will be the CEO’s most valuable allies.

Creating a credible regulator/law enforcement partnership makes an industry far less criminogenic (though one must remember the risk of simply displacing crime). I have discussed above how limiting growth and making entry even modestly more difficult materially reduce the risk of epidemics of accounting control fraud.