(via the Huffington Post)

I get President Obama’s “regulatory review” plan, I really do. His game plan is a straight steal from President Clinton’s strategy after the Republican’s 1994 congressional triumph. Clinton’s strategy was to steal the Republican Party’s play book. I know that Clinton’s strategy was considered brilliant politics (particularly by the Clintonites), but the Republican financial playbook produces recurrent, intensifying fraud epidemics and financial crises. Rubin and Summers were Clinton’s offensive coordinators. They planned and implemented the Republican game plan on finance. Rubin and Summers were good choices for this role because they were, and remain, reflexively anti-regulatory. They led the deregulation and attack on supervision that began to create the criminogenic environment that produced the financial crisis.

The zeal, crude threats, and arrogance they displayed in leading the attacks on SEC Chair Levitt and CFTC Chair Born’s efforts to adopt regulations that would have reduced the risks of fraud and financial crises were exceptional. Just one problem — they were wrong and Levitt and Born were right. Rubin and Summers weren’t slightly wrong; they put us on the path to the Great Recession. Obama knows that Clinton’s brilliant political strategy, stealing the Republican play book, was a disaster for the nation, but he has picked politics over substance.

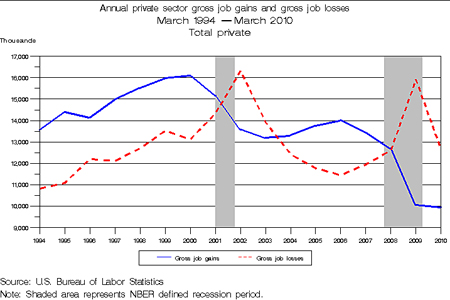

I explained in a prior column how the anti-regulators made the crisis possible and caused the loss of over 10 million jobs.

Anti-regulation proved to be a profoundly negative sum “game” in the financial sphere. Both principals — the home borrower and the lender — lost (negative Pareto optimality). The unfaithful “agents,” however, made out like bandits.

Effective financial regulation is essential to protect honest firms and consumers from the frauds — it is distinctly positive sum. The primary purpose of financial regulation is to limit fraud. President Obama, Summers, and OMB do not understand this fundamental aspect of financial regulation — limiting fraud. Consider this portion of the President’s letter:

This is the lesson of our history: Our economy is not a zero-sum game. Regulations do have costs; often, as a country, we have to make tough decisions about whether those costs are necessary.

Voluntary transactions should be positive sum — both parties are typically made better off. Fraud causes negative sum transactions. Regulators are the “cops on the beat” in finance. If cheaters prosper, then “private market discipline” drives honest firms and officers out of the marketplace. Vigorous financial regulation is essential to the effective prosecution of elite criminals. Many of the best financial regulations impose virtually no cost. The traditional underwriting rules, for example, would have been exceeded by any honest, competent bank. Indeed, the rules reduced costs to honest firms. The rules imposed material costs only on dishonest managers — and that reduces costs to hones firms and managers. Net, underwriting rules produce enormous net-benefits. That is equivalent to saying that they have a negative cost. The underwriting rules designed primarily to reduce fraud also reduce losses from incompetence, unrecognized risk, and mistake. This means that financial rules designed primarily to reduce fraud are essential to convert the negative sum (fraudulent) transactions that would prevail absent regulation into positive sum (honest) transactions. Because fraud can impose severe “negative externalities,” this transaction-based analysis dramatically understates the net cost savings of effective safety and soundness regulation.

Obama’s proposal and the accompanying OMB releases do not mention the word or the concept of fraud. Despite an “epidemic” of fraud led by the bank CEOs (which caused the greatest crisis of his life), Obama cannot bring itself to use the “f” word. The administration wants the banks’ senior officers to fund its reelection campaign. I’ve never raised political contributions, but I’m certain that pointing out that a large number of senior bank officers were frauds would make fundraising from them awkward.

President Obama’s explanation for his regulatory review program warrants detailed analysis in multiple columns. He decided to place it in the Wall Street Journal as a symbol of his efforts to placate Wall Street (only two sentence of his letter refer to small businesses).

My first column discussing his regulatory review program focuses on gaps in financial “safety and soundness” regulation. This is an area I lived, research, write about, and teach. (If you look at my bio you will see that public administration experts write about my experiences as a regulator.) Obama entitled his letter: “Toward a 21st-Century Regulatory System.” Where have we heard that mantra before? When President Clinton signed the Gramm-Leach-Bliley Financial Services Modernization Act of 1999 Larry Summers proclaimed that the GLB Act was “a major step forward to the 21st century.”

Clinton’s two great deregulatory failures were the GLB Act and the Commodities Futures Modernization Act of 2000 (CFMA). The CFMA deliberately created a regulatory “black hole” for credit default swaps (CDS) by removing the CFTC’s authority to regulate CDS and a regulatory black hole in the trading of energy derivatives that helped Enron’s cartel produce the California energy crisis of 2001. The titles of both of these deregulatory acts included the word “modernization” and the great lie was that the acts they were repealing were archaic. The claim was that we needed a regulatory system designed for the 21st-Century. Summers, Obama’s principal economic advisor, framed Obama’s latest deregulatory foray.

Summers and Rubin remain unwilling to admit that their anti-regulatory financial policies were disastrous. Here’s what Obama said in late 2008 about the decisive role that anti-regulatory dogma played in causing the ongoing financial crisis.

“John McCain has spent decades in Washington supporting financial institutions instead of their customers,” [Obama] told a crowd of about 2,100 at the Colorado School of Mines. “So let’s be clear: What we’ve seen the last few days is nothing less than the final verdict on an economic philosophy that has completely failed.”

Obama’s subtitle is designed to illustrate stupid regulation: “If the FDA deems saccharin safe enough for coffee, then the EPA should not treat it as hazardous waste.” The example is supposed to be self-evident, clearly only regulators could do something so stupid. But the facts are inconvenient to Obama’s scorn — and this is his shining example, the best that the scores of OMB staff that review thousands of regulations could come up with to support this major administration initiative. This is the dumbest rule they found. Obama’s statement about saccharin may seem logical, but it is not. Animal studies originally showed that saccharine was carcinogenic in doses that a heavy consumer might experience. The EPA, therefore, classified the disposal of large amounts of saccharine as toxic. Subsequent studies are now interpreted as showing that saccharine is unlikely to be carcinogenic at such dosage levels. The EPA’s classification of saccharine as a hazardous substance for waste disposal purposes based on its carcinogenic effects in small doses was logical. The logic does not work automatically in reverse. An ingredient can be safe to consume by an individual consumer in extremely low doses yet hazardous in far larger doses. To sum it up, the supposedly dumb rule Obama chose as his lead example did not kill any meaningful number of jobs, was based on the best science then available, and wasn’t dumb.

Consider the overall logic of Obama’s approach to regulation. Under his logic during the campaign, the imperative need was to end the anti-regulatory dogma that was the disastrous product of “an economic philosophy that has completely failed.” When he became President, however, Obama placed Summers and Rubin, the leading Democratic Party purveyors of that completely failed philosophy, in charge of the administration’s financial regulatory policies. The administration’s policies are largely anti-regulatory. The most important indicators of this point are the things not in the President’s regulatory review program. Obama says that the lack of financial regulation made possible the financial crisis, but his regulatory review program does not require the administration to search out areas of inadequate regulation. Here is the closest Obama comes: “Where necessary, we won’t shy away from addressing obvious gaps….” Huh? The vital task is to find the non-obvious gaps. Why, two years into his presidency, has the administration failed to address “obvious gaps”? The administration does not need Republican approval to fill obvious gaps in regulation. Even when Obama finds “obvious gaps” in regulatory protection he does not promise to act. He will act only “where necessary.” We know that Summers, Rubin, and Geithner rarely believe that financial regulation is “necessary.” Even if Obama decides it is “necessary” to act he only promises to “address” “obvious gaps” — not “end” or “fill” them.

In the financial sphere, Obama has allowed “obvious gaps” to persist and, by listening to Summers’ continued embrace of an “economic philosophy that has completely failed” he has even made the gaps worse. Obama’s regulatory review program does not promise to fix any of the anti-regulatory actions taken or allowed to fester and grow under his administration. I provide twelve specific examples of these obvious gaps in financial regulation which have persisted and grown during this Obama’s first two years in office. (There are more than a dozen gaps, but it is premature to address some of them, e.g., Basel III, the Volcker rule, and the new consumer financial protection agency, because there is so much uncertainty about the rules that will emerge.) The gaps addressed here are those where Obama has not even proposed to take an action that could prove effective.

The “Dirty Dozen”

- Executive compensation is so profoundly perverse that it is intensely criminogenic, but the administration has opposed the FDIC’s modest efforts to reduce the problem. (Both Treasury officials on the FDIC Board voted against the FDIC proposed rule to limit the perverse incentives of modern executive compensation.

- Professional compensation is equally perverse. Bank CEOs created the perverse incentives that produced “echo” epidemics of fraud by appraisers, loan brokers, and mortgage bankers. Bank CEOs deliberately create a “Gresham’s” dynamic in order to create the perverse incentives that have routinely allowed them to suborn successfully “independent” professionals and turn them into fraud allies. As long as the CEO can hire and fire the independent professional he can succeed in suborning some of the professionals — and “some” is ample. Then Attorney General Cuomo’s investigation, for example, found that Washington Mutual kept a black list of appraisers — but appraisers were black listed if they refused to inflate the appraisals. (It is critical that the reader understand the significance of this finding. Only the lender and its agents can extort the appraiser in order to secure an inflated value. No honest lender would inflate, or permit the inflation of, appraised values. Appraisal fraud is a superb “marker” of accounting control fraud.) Dodd-Frank has some provisions seeking to improve appraisals and credit rating agencies, but the essential “gap” that must be closed now is the ability of the CEO to pick the independent professionals.

- Honest accounting is the prerequisite effective financial regulation. The administration stood by while Bernanke, the Chamber of Commerce, and the specialized bank lobbyists used Congress to extort the Financial Accounting Standards Board (FASB) to pervert the accounting rules so that banks would not have to recognize their losses. The administration knows that perverting the accounting rules in this manner harms the public in many ways. Not recognizing losses creates fictional bank income and capital. Banks that are deeply insolvent and unprofitable are able to claim to be solvent and profitable. This allows the banks to evade the Prompt Corrective Action law and makes it more difficult for regulators to prevent expensive bank failures. It also allows the controlling officers to pay the officers tens of billions of dollars in bonuses that the officers have not earned. The same accounting scam makes the administration’s (self) vaunted “stress tests” a sham. Obama can end the banks’ accounting scams and end these anti-regulatory disasters at any time because banking regulators have the power to impose regulatory accounting principles that would restore honest accounting and restore effective bank regulation. I shouldn’t have to keep emphasizing this, but honesty in accounting is also essential to integrity – and integrity is essential to everything.

- The accounting scams combined with the Fed’s secret bailouts of insolvent U.S. and foreign banks also allowed the administration to enter into a cynical gambit on TARP. The continuing Fed’s subsidies are far larger than TARP. Bank CEOs were eager to get out of the TARP restrictions on executive compensation. The administration was eager to claim (A) that it had resolved the banking crisis, and (B) that it did so for a pittance. The accounting cover up of bank losses combined with the Fed subsidies were the perfect (political) answer that met the banks’ and the administration’s greatest desires. The combination allowed the banks to repay TARP. The banks got to hide their losses, receive large subsidies and cheap liquidity from the Fed, and report fictional profits that allowed them to repay the TARP funds and pay large bonuses to their officers. The administration got to make the absurd claim that it had resolved the largest banking crisis in U.S. (measured in absolute dollars) for a pittance (roughly20 billion). (The real economy and real estate losses in the many trillions of dollars produced20 billion in bank losses. “Too good to be true” hardly does justice to the absurdity of Geithner’s claims that he “resolved” the failures virtually without cost.) The combination of covering up and secretly subsidizing the SDI’s losses also explains the SDIs’ unwillingness to lend to the real economy. It’s safer to borrow funds from the Fed at next to nothing, buy bonds, and clip coupons. This perverse dynamic is one of the important factors, along with fraud, that has made the economic recovery so weak. We are following the failed Japanese strategy.

- The Fed is an “obvious gap” in regulation. The Fed has consistently sought to prevent the Congress and the public from learning the disgraceful facts of its bailouts and subsidies of the most undeserving rich in modern history. TARP did not resolve failures. The failures have been covered up and subsidized by the Fed. There is an urgent need to regulate the Fed. The Fed has a consistent record of regulatory failure and is actively hostile to transparency. During Obama’s term in office, Bernanke appointed as the head of all Fed examination and supervision an economist with no experience as an examiner or regulator. The economist is a strong proponent of the anti-regulatory economic philosophy that completely failed. Greenspan used him as the agency spokesman before Congress supporting the passage of the Commodities Futures Modernization Act of 2000 – the Act that created the multiple regulatory black holes that allowed the frauds that caused the California energy crisis of 2001 and contributed to the frauds that drove the ongoing financial crisis.

- The Fed’s regional banks have private directors with untenable conflicts of interest. The U.S. has already reached the policy decision in 1989 that such conflicts pose an unacceptable danger of producing ineffective regulation when it enacted FIRREA, which removed any conceivable authority of the private directors over the regulatory process.

- The administration could end the obvious gap in regulation known as the “too big to fail” doctrine at any time by adopting regulations that would stop the systemically dangerous institutions (SDIs) from growing and shrink them to the scale they would no longer pose a systemic risk within five years. (These regulatory gaps interact – many of the SDIs are insolvent yet are paying extraordinary bonuses to the officers that caused their massive, unrecognized, losses.) Instead, of shrinking the SDIs, the administration encouraged the SDIs to grow even larger and pose greater systemic risk. The administration opposed efforts to amend the Dodd-Frank bill to require the end of the SDIs. Remember, it is the administration that is telling us that there are 20 U.S. banks so large that as soon as the next one fails it is likely to trigger a systemic crisis. It is insane to roll the dice twenty times a day waiting for the next world crisis. The SDIs are one of those “obvious gaps” that the administration doesn’t find it politically correct to “address.” Effectively regulating the SDIs would be the antithesis of the administration’s campaign to ingratiate themselves with the SDIs.

- The administration could end the scandal of the lack of prosecution of the accounting control frauds that created the epidemic of mortgage fraud that hyper-inflated the largest bubble in history and drove the financial crisis and the Great Recession. Effective prosecutions against elite bank frauds are possible only with effective regulation and supervision. We know that the banking regulatory agencies – which made well over 10,000 criminal referrals in response to the far smaller S&L debacle (producing over 1000 felony convictions in “major” cases against elites – made no, or a handful of criminal referrals in response to this crisis. The Office of the Comptroller of the Currency (OCC) and the Office of Thrift Supervision (OTS) made zero criminal referrals during the crisis. The FDIC apparently made a very small number of criminal referrals, probably not against elites. It is unknown whether the Fed made any criminal referrals. There is no evidence it made any significant criminal referrals. The banking regulators’ dereliction of their duties to make criminal referrals is so complete that the FBI formed a “partnership” with the Mortgage Bankers Association (MBA) – the trade association of the perps – rather than with the banking regulators. Unsurprisingly, the MBA claimed that the banks were the victims of borrowers and junior officers rather than the CEOs who knowingly created the perverse incentives that drove the epidemic of mortgage fraud.

- Only 25 banks – during an “epidemic” of mortgage fraud – made any significant number of criminal referrals, and none of those referrals appear to have been made against the senior bank officers that caused those frauds. Federal rules mandate that the banks file criminal referrals against suspected mortgage fraud, so the data demonstrate endemic regulatory violations by banks. The data also demonstrate that the banks overwhelmingly did not want the FBI to prosecute the mortgage frauds. There is one obvious reason why the banks’ CEOs would be willing to violate a legal mandate to file criminal referrals. I have not found any evidence that the banking regulatory actions have brought enforcement actions against the banks committing these obvious, endemic violations of the law. The mortgage bankers and brokers were not federally insured and therefore were not subject to the rules mandating that they file criminal referrals when they found suspicious activities likely indicating mortgage fraud. The mortgage bankers and brokers, however, were permitted to file criminal referrals. Their nearly universal failure to do so was irrational for honest lenders and brokers – but optimal for control frauds. The administration has allowed the collapse of the criminal referral system within the regulatory agencies, and almost all lenders to continue on its watch. It could fix the scandal of elite bankers being able to loot with impunity without adopting any rules. Each collapse constitutes an “obvious gap” that urgently requires Obama’s attention.

- The Mortgage Electronic Registration Service (MERS) is unregulated. MERS, at best, was a system designed to evade county recorder fees. No one – and that includes MERS’ controlling officials – knows the true condition of the mortgage instruments that MERS is supposed to be registering. At best, it is a scandal that threatens the stability of homeowners and holders of instruments that are supposed to be secured by mortgages. MERS is an “obvious gap” in regulatory protections that demonstrates once more the wealth and job destroying consequences of the “completely failed” anti-regulatory philosophy that Obama promised to root out.

- The foreclosure scandal revealed an “obvious gap” in regulatory protections – no one regulates the foreclosure process. (The underlying epidemic of accounting control fraud by the nonprime mortgage lenders generated the “echo” epidemic of foreclosure fraud.) Bank of America, the second largest financial institution in America, acquired Countrywide in order to secure its personnel and its mortgage servicing portfolio. Countrywide was notorious for its fraudulent and predatory mortgage lending practices. Placing its employees in charge of servicing – the banking operation that controls the foreclosure process – guaranteed epic abuses. (Bank of America also managed to generate pervasive foreclosure abuses out of the staff it had prior to acquiring Countrywide.) Bank of America personnel, and personnel of other major servicers, eventually confessed that their foreclosure actions relied on massive, universal perjury (a felony). These “robo signing” crimes occurred at a frequency of roughly 10,000 monthly at more than one large servicer. Our most elite banks have confessed to committing hundreds of thousands of felonies.

- Fannie and Freddie. These entities are twisting slowly in the wind. Private and regulatory leadership have been ineffective and have lacked courage. I’ll mention only two areas. Fannie and Freddie used some of the most abusive foreclosure law firms in existence. Citicorp’s key mortgage credit guy testified many months ago before the Financial Crisis Inquiry Commission (FCIC) that 80% of Citi’s mortgages sold to Fannie and Freddie were sold under false “reps and warranties.” The Citicorp official’s warnings to his superiors about this extreme incidence of fraud did not lead to corrective action, so the official cc’d Rubin on key correspondence. Naturally, Citi responded by firing the whistleblower rather than the frauds. If Fannie and Freddie put the bad paper back to Citi, then Citi would be insolvent and Rubin would face serious risks. Fannie and Freddie have put only relatively small amounts of Citi’s paper back to Citi. (Note that the extreme incidence of fraud, and a similar incidence has been shown in Countrwide mortgage paper, again demonstrates how completely failed the anti-regulatory model is.) I have explained previously why Fannie and Freddie, because of their large holdings of nonprime paper from many originators and their dealings with credit rating agencies, offer unique data bases and opportunities for research to document exactly what wrong and how the fraud epidemic, bubble, and financial crisis grew and spread. This is a more subtle, but enormously important and dangerous regulatory gap.